Mumbai: The mobile payments market in Travel & Tourism is growing. More and more travellers are using mobile devices to pay for travel-related services and an increasing number of service providers are implementing mobile payment options. This growth is being driven by the convenience, ease, speed and simplicity favoured by both travellers and service providers. For service providers, the additional value of mobile payment lies in low processing fees, the ability to engage travellers throughout the trip, and the capability to track business performance.

A study by World Travel & Tourism Council (WTTC) identifies opportunities for travel & tourism service providers to capitalise on the trends and growth of mobile payments

The white paper on Mobile Payments in Travel & Tourism: Unlocking the Potential published by World Travel & Tourism Council (WTTC) in association with The US-Asia Chapter for Tourism & Hospitality Research explores the landscape of mobile payment in travel & tourism and identifies challenges and opportunities for travel & tourism service providers to capitalise on the trends and growth of mobile payment. It looks to the future in terms of the needs for agile governance and new policymaking in this new area of digital financial transactions.

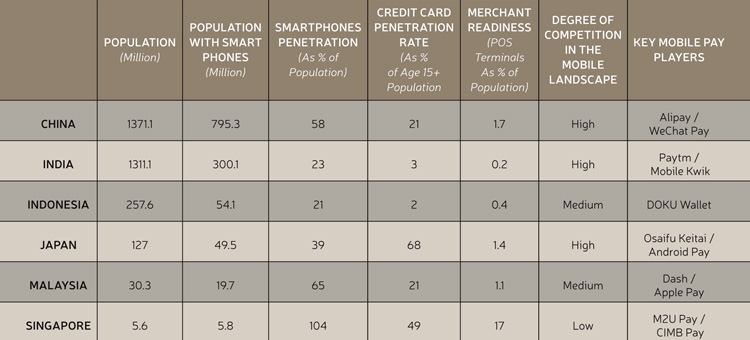

For many travel service providers around the globe, Asia is an extremely important source market. WTTC data shows how South Asia and South-East Asia are the fastest-growing regions for outbound travel globally with forecast growth of 5.8 per cent and 5.1 per cent respectively for each of the ten years to 2028. In particular, China continues to rank as the number one country in outbound travel expenditure. At the same time, as smartphone penetration grows and mobile payments gain ground throughout the world, Asia-Pacific, and notably China, have emerged as clear market leaders. In 2017, the penetration rate for mobile payments among smartphone users in China was 46 per cent – twice the level of North America and 13 per cent more than the global penetration level.

In China and a small number of other countries, mobile payment is establishing itself as the default method of payment. Indeed, over 60 per cent of all global mobile payment users are Chinese and Alipay and WeChat Pay dominate the overseas mobile travel payment market. To attract Asian consumers, internationally-based travel service providers are finding that adopting mobile payments as a strategy is becoming essential. The earlier a travel-related merchant enters the mobile payment field, the more likely it is to achieve an advantageous position in competing for the Asian market.

Despite the growth however, mobile payment services are not perfect, and travellers and merchants express a number of concerns particularly calling for greater reassurances over the security of payments, a need for established regulations and policies, a lack of interoperability between systems and the need to increase consumer understanding about the benefits of mobile pay. These issues will need to be addressed to further the acceptance, implementation and adoption of mobile payment technology at the global level.

Still, both travellers and service providers have concerns which could hinder universal mobile payment adoption. Notably, travellers worry about payment security and prefer a larger merchant coverage. Meanwhile, service providers attribute the limited merchant coverage to the lack of established regulations and global mobile-pay solutions. A number of recommendations can therefore be put forward for service providers and policy makers in regards of the wider application of mobile payment.

Lack of interoperable mobile pay solutions result in user complexity for both consumers and merchants. To use a particular mobile pay service, consumers need to download a new app, learn a new system and sometimes complete a new set of enrolment procedures. This could result in difficulty for international travellers. Similarly, on the merchant end, too many terminals or QR code options that cater for international tourists could result in operational complexity, which would be another reason for merchants to hold back from adopting mobile pay.

Consumers don’t want to have to download a new app or learn a new system every time they cross a geographic border. Similarly, merchants want a single software that can enable all their payment options, not a series of terminals and QR stickers congesting their counters. Meaningful growth in mobile payments will come from designing solutions with global applicability in mind – Mathieu Altwegg, Vice President, Innovation, Engagement, Asia-Pacific, Visa

China has leapfrogged the world when it comes to mobile payments. Currently, 61.2% of the global mobile payment users are Chinese, with transactions made through mobile payment in China totalling over $12.8 trillion in 2017. According to data collected by Temple University’s China-US Travel Monitor Program, 97% of the Chinese respondents sampled, confirmed they have used mobile payment during domestic and/or international travel. As the world’s biggest spender in outbound travel and largest mobile payment market, China is leading this payment behaviour trend among global travellers.

As mobile payments gain ground throughout the world, Asia-Pacific and notably China, have emerged as clear market leaders. In effect, according to Global Web Index, the growth in mobile payments mostly comes from the Asia-Pacific region; with 33% of smartphone users employing mobile payments in 2017, amounting to an 11 per cent growth since 2015.

Convenience, speed and security are the drivers for the adoption of mobile payments. For Chinese travellers using mobile payment overseas, the top reasons are convenience (67%), quicker checkout (61%), no need to exchange foreign currency (46%), security (43%), no need to bring a wallet while travelling (38%), and access to coupons/rewards/ discounts (22%).

In Africa, Europe, Latin America, the Middle East and North America, mobile payment growth ranged from 3% to 6%, while in Asia-Pacific (excluding China) it reached 9%. In 2017, the penetration rate for mobile payments among smartphone users in China was 46 per cent – twice the level of North America and 13% higher than the global average.

Key Recommendations

Travel service providers need to recognise that using mobile payment is being demanded by travellers. It has powerful business service functions and low transaction fee that may be particularly beneficial for small and micro travel businesses that proliferate in the sector. Incentives for its use and reliable WiFi would help to increase both use and satisfaction.

As mobile pay services are largely bound by individual country markets, an interoperable solution to connect diverse mobile pay systems is needed to resolve both consumer and merchant complexity. This system also requires improved business services to establish infrastructure, and to develop the right employee training so that customer issues and service outages can be resolved in real-time.

For policy makers and regulators, maximising the opportunities that mobile payment systems can bring to an economy requires regulations to catch up with technology. Moreover, as different countries have different regulatory policies when it comes to mobile pay, individual traveller expenditure as well as tax, a system that would work best for international travellers would be one where global mobile payment platforms are standardised and interoperable.

While some hesitancy to implementing mobile pay are rightly driven by concerns such as safety and regulations, the lack of mobile pay penetration in many areas around the globe, is often rooted in inertia. A change requires the private sector to lead the efforts to provide education to government, regulatory bodies, the public and merchants not only of the value of mobile pay but also of its potential risks and issues. If properly initiated and implemented, Travel & Tourism could be at the front line of adopting mobile payment and pioneering a country’s policies and regulations in this area that then permeate through to an entire economy.