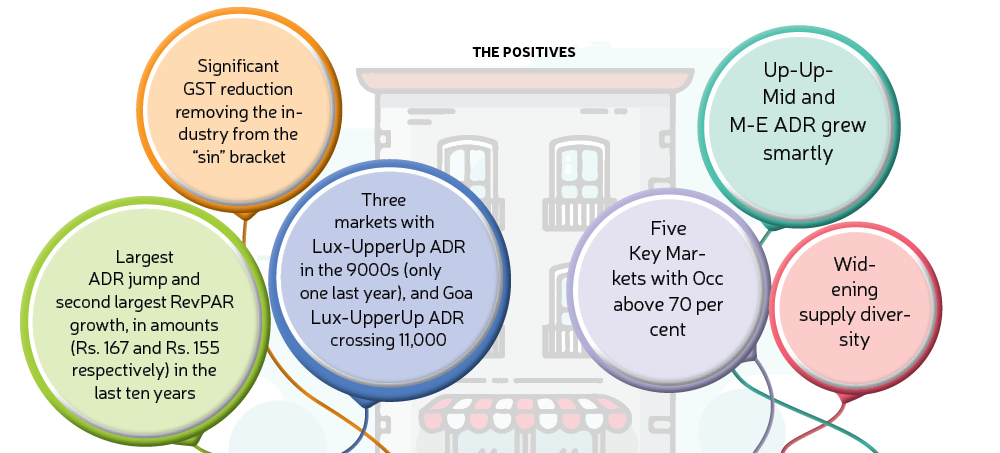

Mumbai: India Hotel Market Review 2019, jointly prepared by Horwath HTL India and STR, reflects occupancy, ADR and RevPAR growth of 0.8 points, 2.9 per cent and 4.1 per cent respectively. In Rupee terms, ADR and RevPAR growth were the biggest and second biggest respectively, in the last ten years. Growth parameters were even stronger on “same store” basis.

Hotels are classified as Luxury & Upper Upscale (Lux-UpperUp), Upscale & Upper Midscale (Upscale-UpMid) or Midscale & Economy (M-E) while analysis is based on full year Occupancy (Occ), Average Daily Rate (ADR) and Revenue per Available Room (RevPAR) data, reported by hotels.

Hyderabad, Bengaluru, Gurugram and Chandigarh recorded double-digit RevPAR growth while Goa, Chennai, Ahmedabad and Kochi posted negative growth

Supply

In macro numbers – supply crossed 1,50,000 rooms; rooms sold per day, corresponding to this supply, is a little short of 97,000 rooms. Supply share outside the Key Markets has risen to 34 per cent, with over 3500 rooms added in 2019.

Bengaluru remains the lead city, in terms of inventory, followed by Mumbai and Delhi (both running neck and neck). Bengaluru is expected to stay in the lead over the next 4-5 years with several projects underway.

As individual cities, Bengaluru has the largest supply with over 14,000 rooms, followed by Mumbai and Delhi.

- Mumbai continues to have the largest inventory in Lux-UpperUp segment

- From a metropolitan area viewpoint, Delhi NCR is the largest with inventory greater than the total rooms in the other three metros (Chennai, Hyderabad and Kolkata)

- These three major metros (Mumbai, Delhi NCR and Bengaluru) comprise 34 per cent of total national inventory

- Supply share of markets, other than the 13 Key Markets has risen from 28 per cent in 2014 to 34 per cent in 2019

- Other markets have limited play in the Lux-UpperUp segment – scattered across multiple cities including Udaipur, Jodhpur, Agra, Lucknow, Chandigarh

- Supply in other markets comprises Upscale-UpMid and M-E hotels; this is perfectly understandable and appropriate – it is also good to see several brands, mainly domestic brands, make inroads into secondary and tertiary markets

- Jaipur is hurting from too much Upscale-UpMid demand, at M-E rates. Goa on the other hand, has a surfeit of M-E supply – on the coast – and that has limitations

Segmental Performance

Luxury – Upper Upscale

With 35 per cent of total inventory, this segment enjoyed a positive year with ADR and RevPAR growth in all Key Markets. Mumbai and Delhi are the only two markets with Occ greater than 70 per cent; Gurugram was almost there.

Upscale – Upper Midscale

With 40 per cent inventory share, this segment is a vital cog for results to churn forward. Mumbai led the Occ chart with 78.4 per cent – the city had crossed 80 per cent in the previous two years. Delhi NCR and its constituents, Kolkata, Hyderabad and Jaipur are in the mid 70s, with Bengaluru just getting to 70 per cent.

Midscale – Economy

With 25 per cent supply share on all-India basis, this segment has grown inventory by 30 per cent in the last three years including 33,000 rooms in 2019. Mumbai and Delhi have each moved by 1.4 points, in 2019; Mumbai declined while Delhi grew to take the lead position from an Occ standpoint. Hyderabad came in at second spot. All three markets are above 75 per cent.

Key Markets Mumbai

Occ moved up to 77.1 per cent; ADR grew 3.3 per cent and RevPAR 3.8 per cent. The Lux-UpperUp segment did reasonably well, growing RevPAR by 5.7 per cent based on Occ and ADR growth.

Delhi

The capital city has come up with a solid performance, improving Occ by three points, ADR by Rs. 200 and RevPAR by 7.3 per cent. It benefitted from nominal supply growth, adding only 1 per cent to its inventory in 2019; total new supply in the last three years is only 663 rooms.

Gurugram (formerly Gurgaon)

Stable supply for the last three years, and demand growth from the services sector have enabled Gurgaon to spring back with four points on Occ and 4.3 per cent on ADR.

Occ grew between 3.1 and 5.2 points across different segments.

Bengaluru

The city appears keen to live up to its inventory leadership status, putting in a strong performance in 2019. 67.6 per cent Occ, 8.1 per cent ADR growth and Rs. 4500 RevPAR are commendable considering the city has added 2200 rooms between 2017 and 2019.

Chennai

100 new rooms; ADR growth of Rs. 108; RevPAR growth of Rs. 110. Even all-India numbers (with non-Key Markets) were better!! The city had the lowest Occ, ADR and RevPAR among metro cities – RevPAR below 3500 is abysmal for a metro city.

Hyderabad

The city continues its Occ growth trend which started in 2014; occupancy touched 71.5 per cent and ADR grew by 9 per cent so that RevPAR was just shy of 4000 (up 11.8 per cent over 2018). During these six years, the city has added 2400 rooms, including 1000 in the last two years.

Kolkata

With 66 per cent Occ (only the decimals have changed) over the last 4 years, the market has been substantially resilient while absorbing 2000 new rooms. Further, city-wide ADR was Rs. 5905 for 2013 and is Rs. 5960 for 2019; in these six years, the lowest it went down to was Rs. 5663.

Goa

Goa lost Occ, ADR and RevPAR in 2019. A decline that could have been avoided – or at least minimised because it has occurred for largely avoidable reasons. A key leisure destination has slipped from 71.2 per cent occupancy to 65 per cent.

Pune

Pune had a soft year relative to its potential. With RevPAR decline of 0.1 per cent, it cannot be considered as a bad year; but the fact is that occupancy declined (compared to 2018) in all but four months, importantly also in February. On the other hand, the market gained rate in every month (including October) enabling 3.6 per cent ADR growth.

Ahmedabad

In 2018, the city broke the cycle of alternate year growth, gaining ADR with a minor loss in Occ and reporting its best numbers in nine years. However, it failed to keep momentum in 2019. Key events were somewhat tepid, causing Occ decline by -0.4 points, ADR loss by -6.8 per cent and RevPAR decline of -7.3 per cent.

Jaipur

Jaipur had a relatively better year (compared to 2018), with increase in Occ by 0.4 pts, rate growth of Rs. 293 and 6.4 per cent RevPAR gain. Occ at 68.4 per cent is very reasonable relative to other similar markets; however, market wide ADR at Rs. 5424 is very low for a key leisure market – it is lower than the ADR for Agra and less than half the ADR for Udaipur.

Kochi

The recovery from 2018 floods has been slow and was not helped by severe floods in 2019. Thus, Occ grew nominally to 56.9 per cent. ADR grew more substantially (Rs. 294) to close a little below 5000. Kochi has 3100 rooms of which 30 per cent has been added in the last three years.

Among Key Markets, Ahmedabad is the lowest in ADR and RevPAR; only Kochi is lower in Occ.

(STR is a trusted source for premium data benchmarking, analytics and marketplace insights. Horwath HTL is the global hospitality consulting brand of Crowe Global)

Highlights

Occupancy for Mumbai, Delhi, Gurugram and Hyderabad was above 70 per cent; Mumbai and Delhi led the way, with 77.1 per cent and 74.8 per cent

All other Key Markets, except Ahmedabad and Kochi were at or above 65 per cent

All India ADR was agonisingly short of 6000. Only Mumbai achieved 8000 ADR, with Goa dropping below to join Delhi in the 7000 level

Udaipur is the lead city, with 11,000 ADR

Bengaluru led ADR growth, up by Rs. 502;

Hyderabad did well too, up Rs. 461

From RevPAR perspective, Mumbai is close to 6500, ahead of Delhi by about 1000, which itself leads Bengaluru and Gurugram by about 1000. Bengaluru, Gurugram and Hyderabad grew by over Rs. 400. Sadly, Goa dropped closer to 5000. Ahmedabad dropped to the bottom at 2600