Mumbai: China, which is currently the world’s second largest cruise market after the US, is expected to take the top spot by 2030 adding 8 to 10 million customers per year, according to figures by the Shanghai International Shipping Institute. Currently, it is estimated that 2.5 million Chinese choose to go on a cruise vacation every year.

According to data released by Cruise Lines International Association (CLIA) in May, 70 per cent of Asia’s 4.24 million passengers in 2018, came from China. Cruise travel has become increasingly popular in both metropolitan cities such as Beijing, Shenzhen, Shanghai, Tianjin and Guangzhou, and smaller cities including Chengdu, Qingdao and Xiamen, according to Ctrip.com, China’s leading online travel agency.

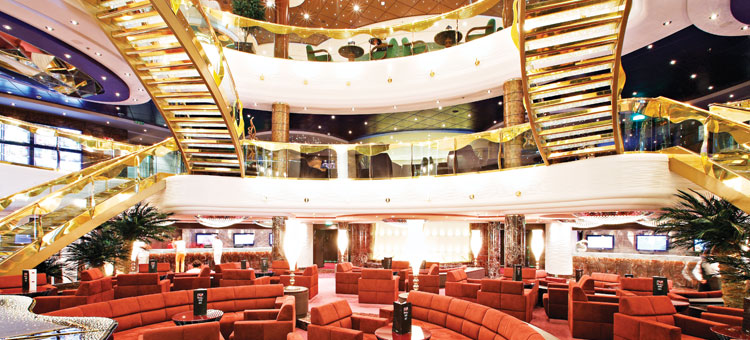

Spend a couple of days in Beijing and Shanghai and then get on board for a cruise that includes Japan, too

“We have huge capacity in the region and our latest equipment is deployed there,” said Varun Chadha, CEO, TIRUN Travel Marketing. Royal Caribbean Spectrum of the Seas which debuted in April 2019 is positioned in Shanghai. So is Quantum of the Seas. Since cruising in China is a predominantly domestic market, the products are also skewed to their distinct taste. “However, we still speak in English, the entertainment content is multi-cultural and the food on-board is multi-cuisine to appeal to all palates,” assured Chadha.

Though the travel time to European cruise destinations and Beijing or Shanghai is more or less the same from say Mumbai or Delhi, the cruise market to China from India is non-existent today. Tour operators sending groups frequently to China argue that it is a land destination and not a cruise destination as far as India market is concerned. Even if one considers Hong Kong, it does just one-third of cruises compared to Singapore, the cruise hub of Asia.

What appeals to Indian travellers to China warrants deeper study. Concerns around wide acceptance of the English language and availability of food that suits the Indian palate keeps many Indians away from China. Indian outbound market’s adoption of China as a holiday destination will not happen in a hurry. 2,20,900 people cruised from India in 2018 as per CLIA. Asia Cruise Industry Ocean Source Market Report 2018, which was released recently by CLIA, says that the number of Indian cruise passengers has gone up by a solid 28.15 per cent.

The number one reason for choosing a cruise itinerary is still the destination. It is strange but true. So port cities become all the more important. A dichotomy is that cruise ships are becoming bigger and better and want to be destinations by themselves!

Kunal Sampat, General Manager – India for MSC Cruises, said that MSC has inventory in China-Japan. MSC Splendida has been home-ported in Shanghai since May 2019. Earlier, MSC Lirica was deployed there. “Along with inventory, we have short 3N itineraries and our pricing is very competitive. Since India is a value-for-money market, I initially thought it might work with Indian cruise customers. But when I spoke to Indian tour operators who do well in China-Japan land packages and especially MICE, they were not enthused about the cruise market.”

The China-US trade war currently on has made the China market unstable resulting in reduced local patronage towards cruising and casinos. Hence, there is a propensity to tap a proximity market like India.

Costa Cruises was the first cruise liner to homeport a ship in the Chinese market as early as 2006 in Shanghai. From 2006 to 2019 Costa clocked tremendous growth in the region. “We have three ships deployed offering 4/5N to 7/8N itineraries. But the Chinese travel agents buy out most of the inventory on charter for domestic consumption, so supply available to other markets is very limited,” said Vasundhara Gupta, Business Development and Marketing Manager, Lotus Destinations (GSA: Costa Cruises India). “While cruise is a good add on for Chinese land packages and even MICE from India, inventory is limited.”

Costa Venezia launched in April this year was the first ship built exclusively for the Chinese market. It has a complete deck dedicated to casino games and the largest shopping arena at sea apart from a wide selection of local cuisines and even décor that appeals to the Chinese travelers. Costa is adding a sister ship to Venezia, Costa Firenze in 2020. The itineraries for Costa Cruises in China homeport from Shanghai, Xiamen, Shenzhen and Tianjin, usually covering the ports of Japan like Kagoshima, Fukuoka, Osaka, Nagasaki and many others.

Genting Cruise Lines’ Star fleet has just one deployment while their Dream fleet is completely absent in the region (Beijing/Shanghai). Very few Indians cruise if you consider the overall outbound market from India. China can be included in the consideration set of a repeat cruise traveller from India; it is less likely to make it to the maiden cruise traveller’s list of probable destinations. The 2017-18 North Korean crisis made cruise operators skip two fabulous port cities, namely Jeju Island and Busan in the region. This turned advantageous for Japan as cruise liners started exploring many ports like Nagasaki, Fukuoka, Okinawa, Kumamoto, Yokohama, Kyoto, Beppu, Nakagusuku, Kobe, Sasebo, Shimonoseki, Kagoshima, Kanazawa and Sakata. The Japanese government has been extremely proactive in building world-class port infrastructure and wooing cruise customers. Japan is also increasingly being sought-after by Indian outbound travelers especially for the Alpine Route and Cherry Blossom experiences.

Bulk of the itineraries on Royal Caribbean is 4/5N in China and they cruise mostly to Japan (Tokyo is a home port for the Royal Caribbean) from Beijing and Shanghai especially because there is visa waiver for cruise passengers in Japan. This year Royal Caribbean grew its itineraries from the core 4/5N to 7/8N and 12N itineraries, too. In the 7/8N itinerary they have added a new port, Vladivostok (Russia).

Costa Cruises does not have 3/4N itineraries from the mainland. MSC Cruises has 3N and above. The Indian cruise traveller predominantly prefers a 2/3N itinerary and the availability seems to be limited. This makes it even more difficult to convince the land vacationer to have a cruise itinerary as an add on.

China is a shorter haul compared to Europe. At thirty to forty thousand rupees return fare in economy class, it is affordable. A single-entry China visa will suffice if the land excursion is planned before the cruise. Spend a couple of days in Beijing and Shanghai and then get on board for a cruise that includes Japan, too. This product, if marketed properly by educating the travel trade, can sit well with India outbound.

China’s domestic cruise market exploded in less than a decade. Jalesh Cruises has started the trend in India, too. If a few more operators hit the seas in India, it will help socialise and democratise cruise as a holiday product in India leading to a market explosion bigger than what was witnessed in China. Chadha puts it succinctly, “This is a supply side-driven business. Put a right ship in a right port at the right time with the right audience and just see the magic.”